The New Standard for Buyer Certainty™

In a Market Where 15% of Deals Die, Don't Risk It.

LoanCert™ introduces a new standard for Buyer Certainty™, closing the Trust Gap™ through Independent Buyer Verification™ before contracts are signed.

Closing the Trust Gap™ in Financed Offers.

Pre-approval letters may signal buyer intent, but they do not always confirm a buyer’s true ability to close. They are often issued early in the process and typically lack buyer acknowledgment of total funds to close, estimated insurance premiums, and full payment expectations.

As a result, critical details are frequently unresolved until after an offer is accepted - including cash to close, monthly payment assumptions, insurance availability and cost, and the depth of financial review.When these realities surface late, confidence erodes. Deals slow down, renegotiate, or fall apart entirely.

That uncertainty is the Trust Gap™, casting doubt on the likely success of a real estate sale for sellers and agents when Buyer Certification™ is absent from an offer.

Where Transactions Break Down.

The Trust Gap™ shows up differently depending on your role.

-

Unclear cash to close expectations

Misunderstood monthly payments

Insurance costs discovered too late

-

Limited visibility into how thoroughly a Buyer was reviewed

No independent confirmation of income, assets, or employment

Risk that financing changes under full underwriting

-

Time invested in Buyers who feel ready but are not fully verified

Offers written before key details are confirmed

Stress and reputational risk when deals fall apart

This gap is not caused by bad actors.

It exists because the system lacks independent verification before offers are made.

How LoanCert™ Closes the Gap.

Independent Buyer Verification™

LoanCert™ is not a lender and does not issue loan commitments or make credit decisions. Instead, we provide Independent Buyer Verification™, a neutral third party review focused on the elements real estate transactions actually depend on.

LoanCert™ verifies that a buyer:

Understands their estimated cash to close

Acknowledges their estimated monthly payment

Accounts for insurance costs

Has had income, assets, employment, and credit reviewed at a deeper level

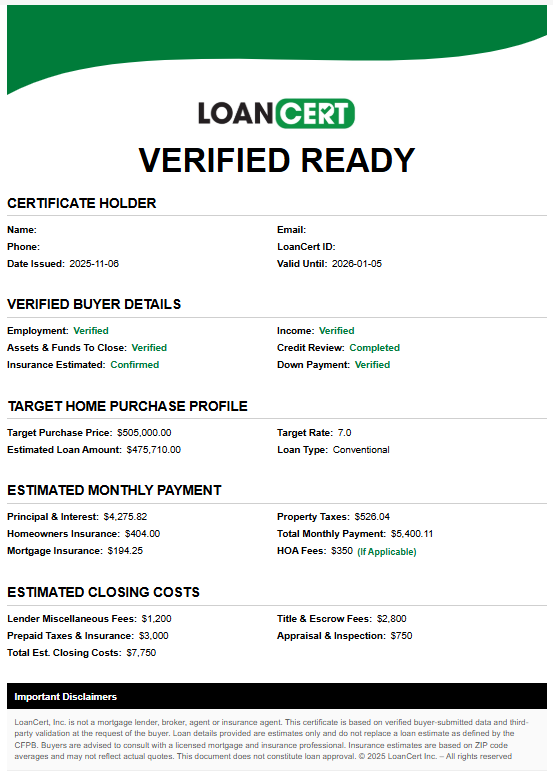

The result is Buyer Certainty™, delivered through the Verified Ready™ Certificate.

The Verified Ready™ Certificate.

Confidence Before the Offer.

The Verified Ready Certificate helps:

Buyers submit stronger, more confident offers

Buyer Agents work with verified and prepared clients

Sellers and Listing Agents evaluate offers with greater clarity

This is not about replacing lenders. It is about reducing uncertainty earlier, when it matters most.

Why This Matters.

Fewer Surprises. Fewer Fallouts. Better Outcomes.

When expectations are clear before an offer is submitted:

Negotiations move faster

Contracts hold together

Transactions close with less friction

LoanCert™ exists to bring structure and transparency to the part of the transaction that has historically relied on trust alone.

That is Buyer Certainty™.

Why Buyer Certainty™ Matters.

Ready to Close the Trust Gap?

Whether you are a buyer, a seller, or an agent representing one, LoanCert™ brings confidence and clarity back into financed offers.